When applying for Texas motorcycle title loans, thoroughly research and compare lenders to avoid hidden fees and unfavorable terms. Legitimate lenders disclose all costs upfront. Pay close attention to interest rates, repayment periods, and additional charges to manage your finances effectively without surprises. Compare rates for truck, boat, or other secured loan options to secure the best deal on Texas motorcycle title loans.

In the vibrant world of Texas motorcycle title loans, understanding hidden fees is crucial for making informed decisions. This guide aims to navigate you through the complexities of loan terms, empowering you to avoid unforeseen costs. Learn effective strategies to secure fair rates and ensure a smooth lending experience. Discover how to identify and mitigate hidden fees, making your Texas motorcycle title loan a practical and beneficial investment.

- Understanding Hidden Fees in Texas Motorcycle Title Loans

- Navigating Loan Terms to Avoid Unforeseen Costs

- Strategies for Securing Fair Rates on Your Texas Motorcycle Loan

Understanding Hidden Fees in Texas Motorcycle Title Loans

When considering Texas motorcycle title loans, it’s crucial to be aware of potential hidden fees that could significantly impact your financial decision. Often, lenders may not immediately disclose all charges associated with such secured loans. Among these may be administration fees, processing costs, and even unexpected penalties for late repayment. These fees can add up, making the already high-interest rates even more burdensome.

Understanding these additional costs is essential for evaluating loan eligibility and managing your budget. A thorough review of the terms and conditions should reveal what’s included in the overall cost of borrowing. Additionally, comparing different lenders’ fee structures can help you secure a more favorable deal on your Texas motorcycle title loan. Keep in mind that transparency is key; legitimate lenders will not shy away from outlining all fees upfront, ensuring both parties are on the same page.

Navigating Loan Terms to Avoid Unforeseen Costs

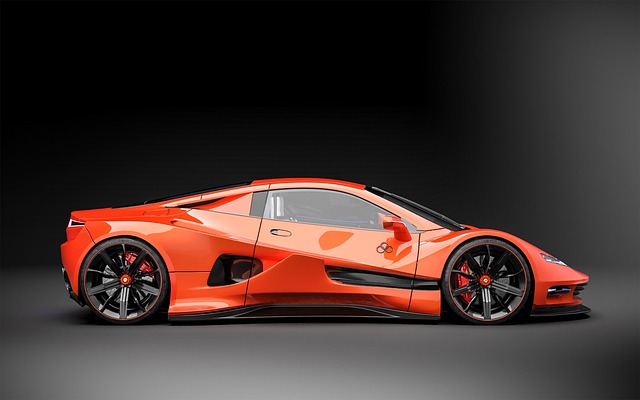

When considering a Texas motorcycle title loan, understanding the loan terms is paramount to avoid unexpected financial surprises. These loans, secured by your vehicle’s title, can be a convenient source of funding for riders in need, but they come with their own set of conditions and fees. Make sure you read through every clause carefully, paying special attention to interest rates, repayment periods, and any additional charges that could significantly impact the overall cost.

One common pitfall is hidden fees, which can include administration costs, processing fees, or even prepayment penalties. These extra expenses can add up quickly, turning a manageable loan into a debt consolidation challenge, especially if you’re already dealing with limited finances due to medical bills, unexpected repairs, or other financial emergencies. With proper research and a keen eye for detail, riders in Houston and beyond can secure the best terms for their Texas motorcycle title loans, ensuring they receive the necessary financial assistance without being caught off guard by unforeseen costs.

Strategies for Securing Fair Rates on Your Texas Motorcycle Loan

When considering a Texas motorcycle title loan, it’s essential to be proactive about securing fair rates and avoiding hidden fees. Start by comparing multiple lenders; this market research will empower you to negotiate better terms. Look beyond the advertised interest rates and scrutinize the overall cost of borrowing, including any additional charges or penalties. Ask about payment structures and terms to understand your financial obligations fully. A transparent lender will provide a clear breakdown of all costs, making it easier for you to choose a loan that aligns with your budget without any surprises.

Remember, while comparing rates, consider not just Texas motorcycle title loans but also other secured loan options like truck title loans or boat title loans. These alternatives might offer different terms and conditions, so evaluating them alongside can help you find the best deal. Be sure to review each lender’s fine print, focusing on any hidden fees associated with early repayment or missed payments, as these can vary significantly between lenders. By taking a diligent approach to your research, you’ll be better equipped to secure favorable rates for your Texas motorcycle title loan.

When considering a Texas motorcycle title loan, being aware of hidden fees and understanding the loan terms is crucial to avoiding unexpected financial surprises. By navigating these aspects carefully, you can secure fair rates and ensure a smooth lending experience. Remember that educating yourself about the process is a significant step towards responsible borrowing for your Texas motorcycle title loan.